The second instalment in a series that examines a dozen useful freight-pricing strategies

Freight-pricing strategies may be of interest to readers and buyers of freight services. The strategies have been selected from some 100 pricing strategies that have been isolated and collected, over a 15-year period, across several countries and three continents.

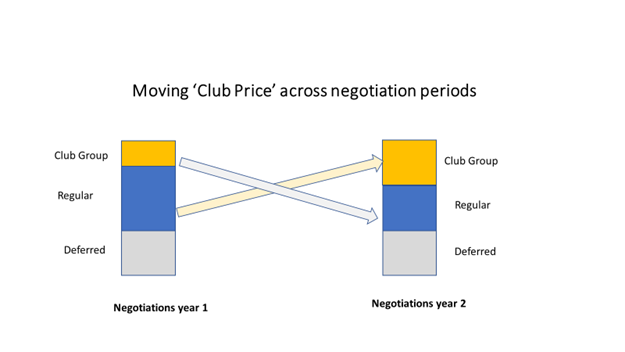

Moving club-based pricing

This pricing scheme was seen before and up to the 1990/91 recession in Australia. This recession in many ways was more severe than the global financial crisis (GFC). The 1990/91 recession started with the property bubble bursting in December 1990, followed by a severe impact on economic demand and employment. Before this recession, many freight customers were somewhat naïve when it came to freight negotiations, whereas now, for many reasons, customers have become far more astute.

Read Part 1, network link pricing, here

How the scheme worked

Moving club pricing was a tiered pricing system as many pricing schemes are. The ‘club’ was usually the highest paying group of premium clients. They were told that they get better service – and perhaps they did – but they also paid higher contract escalations. However, the downside of the scheme was that, to remain in the ‘club’, you paid higher prices and were subtly threatened with being dropped from the club should you not continue to pay the higher price increments. The customer would then be no longer be part of the club.

Surprisingly, before the recession, many clients went along with this scheme. Paying up to be part of the club proved to be a useful business model for some time. For one large express operator, there was actually a ‘Top 40’ club, even though there may not have actually been 40 customers in it.

What happened?

As interest rates and inflation subsided, the requirement for continued high freight rates and escalations began to be resisted as customers became more astute in their negotiations. Customers started to ask their providers why they should get rate increases at all and, if so, to justify these increases. The ‘moving club’ strategy morphed into a ‘tiered’ pricing model, usually: priority (express), regular, and deferred (off peak). Whether by these segment names, or other names, customers could negotiate their respective levels of service.

Often in the early days of householder B2C e-commerce, there was only one level of delivery service being offered to the customer, and this could be pricey. Since then, many e-merchants have certainly adopted more than one, and sometimes three or four, delivery options reflecting different buyer levels of service.

The logistics and purchasing acumen of the customer eventually killed the ‘moving club price’. The profit margins enjoyed before the 1990/91 recession have generally dwindled since that time. Even the GFC had a further impact on contract purchasing as did the rise, fall, and rise again of diesel prices. All of these events have kept margins tight. Contract timeframes moved from 10×1 periods to 5×2 periods, to a 3x1x1, and even shorter contract periods. The customers have become empowered, and operators are working harder to protect their margins. Both technology and a good costing system is very important to this end, but that’s another story.

Dr Kim Hassall is director Industrial Logistics Institute and a noted transport and logistics academic