As the leading supplier of heavy-duty trucks to the Australian market, Volvo Group Australia – Volvo, Mack and UD – has every reason to feel pumped and positive. What’s more, and despite a decidedly trite ‘cone of silence’ on new product initiatives, there’s plenty happening behind the scenes to keep the ball rolling. The ball, however, appears to be rolling smoother for some than others

|

|

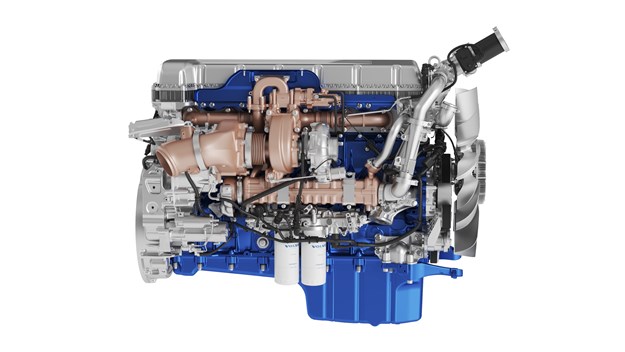

Volvo’s turbo-compound D13TC engine. Now available in the US and Europe, and almost certainly being trialled in Australia along with a 16-litre version

|

Every two years on the eve of the Brisbane Truck Show, Volvo Group Australia (VGA) holds a media conference to discuss, among other things, the state of play of each of its three brands and more broadly, deliver an overview of the business and fiscal factors affecting Australian road transport.

All up, it’s a worthwhile exercise with the brand executives from Volvo, Mack and UD each extolling the strengths of their respective products, expressing opportunities still to be tapped and very occasionally, exposing snippets of recent technological advances from within the corporate kingdom.

It’s also an event where VGA’s latest leader meets the Australian trucking media en masse for the first time; or at least that has been the case with the last two to join the long line of VGA presidents, namely former chief and executive extrovert Peter Voorhoeve, and since September last year, the seemingly more reticent and canny Martin Merrick.

Anyway, after the presentations comes the Q&A session where the media mass breaks into small groups for a few minutes of question time with the leader of each brand as well as a face-to-face chat with the boss. These are sometimes good sessions. Other times not. It all depends on the question.

Like, if you’re seeking insights into the reasons behind the group’s modern success or the qualities that define the appeal of a particular make and model, then this is the time to sit with pen poised, ready to write. If, however, you’re hoping for even a vague answer to any question on upcoming product developments, well, you might as well park the pen because all you’re likely to get is a repeat of the tired, dismissive and somewhat snide response that goes along the lines of “we never talk about future product”.

The thing is, though, in this age of information overload, instant communications, and the obvious amortisation that drives every corporate giant in every corner of the globe, it is an increasingly lame and even churlish response.

Take Volvo, for instance, and the question of whether or not the 13-litre D13TC turbo-compound engine now available in America and Europe is being tested here in preparation for our market.

|

|

Turbo-compound D13TC was added to Volvo’s European stable in March this year, specifically to partner and derive maximum effect from the I-Save drivetrain package

|

Following the TC engine’s release in America and more recently Europe, it doesn’t take the nous of Nostradamus to speculate that it is most likely being trialled here, largely to improve the efficiency, performance and even lifespan of Volvo’s (and possibly Mack’s) versatile 13-litre engine in the hard and fast world of linehaul B-doubles.

Spurring the speculation even further are the non-committal responses to the likelihood of a 16-litre turbo-compound engine also being trialled here, probably under the cab of a nondescript white Globetrotter pulling roadtrains out of Toowoomba.

Even so, when asked the question at this year’s media conference and despite the D13TC’s European launch just a few months earlier, an immovable Merrick would not be swayed from the same old, hackneyed corporate script, saying that when it comes to potential new products, he can’t and won’t comment one way or the other.

A typical corporate response, for sure, but nonetheless disappointing from a Scot whose reputation and background purport a preference for rational rhetoric rather than corporate clichés.

Yet, when it comes to turbo-compounding, anyone with their ear close to the ground knows only too well that Volvo Group is revisiting the technology in a big way despite much earlier experiences that were memorable for all the wrong reasons.

This time around, however, turbo-compounding is being applied in the pursuit of greater efficiency rather than to simply fill a performance gap; a pursuit that suits Volvo’s local ambitions right down to the ground.

|

|

Holding the corporate line. Volvo Group Australia (VGA) chief Martin Merrick would not be drawn on whether VGA is testing turbo-compound engines

|

SOME BACKGROUND

In basic terms, a turbo-compound system employs a second turbine driven by engine exhaust, which captures a significant proportion of the heat energy that would otherwise be lost through the tail pipe and, by channelling it through a gear train and clever fluid coupling, punches more power into the crankshaft via the flywheel. In principle and in practice, turbo-compounding is an effective waste recovery system.

Complex and costly as it may appear though, there is nothing particularly new about the technology. In fact, ‘the other Swede’ Scania was first of all the world’s truck makers to offer a turbo-compound production model when it introduced a 400hp (298kW), 11-litre lump around 30 years ago.

Cummins, Daimler, Iveco and obviously Volvo are among others who over several decades have also spent plenty on development and testing of turbo-compound systems, with varying levels of success.

As we reported a few months back, Volvo’s first use of turbo-compounding in Australia came soon after the arrival of the new century when, in desperate need of higher horsepower to meet increasing B-double demands, a 500hp (373kW), 1,770 lb ft (2,400Nm) turbo-compound version of its former D12D 12-litre engine was released here with some highly hopeful fanfare.

However, in both durability and efficiency, it did not do particularly well and the subsequent arrival of a reborn 16-litre engine followed two years later by an entirely new 13-litre displacement saw turbo-compound technology abruptly shelved, seemingly forever.

But as the saying goes, ‘never say never’.

This, for instance, from a recent report by respected British trucking scribe Brian Weatherley writing in UK publication Commercial Motor, ironically likening Volvo’s return to turbo-compounding as something akin to a boomerang: “Just when you thought Europe’s truck makers had thrown it away, back it comes. And just like the curved stick that circles back, compound turbocharging returns otherwise wasted exhaust gas energy back into an engine, boosting its power and torque, all for free.”

|

|

Flashback! ‘The other Swede’, Scania was first in the world to bring turbo-compounding to the market with a 400hp 11-litre model around 30 years ago

|

Europe, however, wasn’t first on the turbo-compound comeback trail. As Weatherley’s comprehensive report noted, just when it seemed turbo-compounding had slipped off Volvo’s radar for good, Volvo Trucks North America (VTNA) late in 2016 announced the arrival of the D13TC engine, along with the claim of ‘a 6.5 per cent improvement in fuel efficiency compared with previous engine models’. Similarly impressive was a 50hp (37kW) gain in output thanks to the captured energy of exhaust gases.

Mack followed suit in 2017 with its version of the same engine, the MP8-TC.

According to Volvo, the D13TC is an entirely new ballgame in the use of turbo-compounding, overcoming the major shortcoming of earlier systems that produced their highest efficiency only when the engine was under full load and at maximum power.

“That was fine if you operated most of the time at maximum weights over tough terrain,” Weatherley comments, “but when engine revs dropped as they invariably would on easy roads or when unladen, their fuel consumption was nothing to write home about.” And that, indeed, was the overall finding in Australia as well.

Delivering the holy grail of strong low-speed performance and appreciably better fuel economy required a new approach, with VTNA product marketing manager John Moore stating that the D13TC “is not the turbo-compound engine of the past. It has been completely redesigned to work at low engine rpm and provide maximum fuel efficiency through extreme (engine) down-speeding.

“We’ve taken the technology of the past and we’ve tweaked it with our own innovations in our integrated driveline, and we’re making it work.

“In the past, turbo-compound designs were set up to run on performance only. You really didn’t see much in fuel efficiency [but] this engine is designed to do both. We designed the D13TC to run at low rpm for maximum fuel efficiency, and to be able to run at 1,400 to 1,500 rpm to give us the performance we need when we do find ourselves in more aggressive terrain,” says Moore.

|

|

Mats Franzen, Volvo Trucks’ director of powertrain strategy. “The reason for using the turbo-compound unit is simply that it saves fuel.”

|

Subsequently, with US experience supporting the case for turbo-compounding, Volvo added the D13TC to its European stable in March this year, specifically to partner and derive maximum effect from the I-Save drivetrain package developed for its flagship FH range. Volvo is claiming a 7 per cent improvement in fuel economy from the I-Save powertrain, utilising (among other things) tall rear axle ratios and a 300Nm boost in peak torque output provided by the turbo-compound system.

As we reported a few months ago, I-Save is the platform for what Volvo describes as a ‘long haul fuel package’ consisting of tailored cruise control and transmission functions, the I-Roll freewheeling feature, a variable output power steering pump to reduce parasitic losses, and automatic engine idle shutdown.

Given that Volvo Australia is saying nothing about its turbo-compounding trials, it’s not known how high the 13-litre engine’s power and torque outputs would be pushed for our market but it’s certainly fair to assume they wouldn’t be any less than current peaks of 540hp (403kW) and 2,600 Nm (1,918 lb ft).

Predictably, the 13-litre TC engine comes with a number of innovations including wave-shaped piston crowns that guide heat and energy into the centre of the cylinders to enhance combustion efficiency. On the scales, the system is said to add around 100kg to the weight of a D13 in Euro 6 guise.

With the engine designed for the Euro 6 emissions standard, Weatherley reports, “in addition to its SCR emissions control system, the D13TC also features cooled exhaust gas recirculation (EGR) which not only further reduces the amount of NOx created during combustion but reduces AdBlue costs too”.

But above all else: “The reason for using the turbo-compound unit is simply that it saves fuel,” says Mats Franzen, Volvo Trucks’ director of powertrain strategy, who adds that, unlike earlier generation turbo-compound engines, the D13TC and I-Save are at their most effective between 1,000 and 1,100 rpm.

“The improved torque level allows the use of a faster rear axle while still maintaining driveability and traction,” Franzen continued.

“The savings created by the I-Save package balance well with the additional cost, resulting in a positive business case for long-haul operators.”

|

|

Silent Anthem. Despite repeated assurances of an imminent launch and an appearance at this year’s Brisbane Truck Show, Mack Anthem is suffering unexplained delays

|

MACK AND UD

As Weatherley wisely concludes: “Given the nature of shared drivetrain platforms within the Volvo Group, it’s not inconceivable that the D13TC could find its way into other heavy truck chassis offered by Renault, Mack or UD.”

Obviously enough, Renault has next to no relationship with the Australian truck market but Mack and UD are critical contributors to Volvo Group Australia and it’s not beyond the bounds of believability that the prospects of both brands could at some stage be bolstered by turbo-compound technology.

In Mack’s case, turbo-compounding already exists in the US market with the MP8-TC 13 litre engine. Locally, however, Mack probably has more immediate matters to contend with than the possibility of turbo-compounding. Anthem, for example.

There has certainly been plenty of noise about the new Anthem model over the past few years but in our neck of the woods, it has been little more than just that. Noise!

Despite a detailed insight of Anthem in the US in early 2018, followed by repeated references to an upcoming Australian launch and similarly, several undertakings that we’ll soon have the opportunity to sample early evaluation units, the only public evidence to date of its local existence was an appearance at this year’s Brisbane Truck Show.

Even so, and despite the unexplained delays, there’s no denying Anthem has the potential to enhance the bulldog’s business to some degree. First, as a direct and modern replacement for the existing Granite model and second, and most importantly, its ability to provide a long overdue stand-up cab and sleeper combination for several models, not least Trident and Super-Liner. It’s not yet known what size sleepers will be available behind a high-rise Anthem cab, though it’s reasonable to assume that at the very least there will be a 36-inch (91cm) bunk similar to the cut-away unit displayed in Brisbane.

Nonetheless, and without any commentary or information to suggest otherwise, Mack’s evolution appears to be stalled or at the very least, locked in bog cog compared to recent developments at Kenworth with its T610 and T410 and perhaps more worryingly, Freightliner’s upcoming Cascadia. As things stand at the moment, Mack could soon find itself being swamped by competitive forces.

|

|

Volvo VNL. Is this classy and technically advanced conventional really out of the question for Australia?

|

Apart from the non-appearance of Anthem, for instance, it’s still to be wondered if and when Mack will be able to offer the world-class safety and powertrain technology emanating from its Volvo parent. Or will those advances only come to fruition if Volvo Group eventually decides to introduce a Mack-badged version of the smart, modern and technologically advanced long-haul conventionals produced by Volvo Trucks North America? Now there’s a thought!

Let’s face it, and despite the North American release of Anthem more than two years ago, Mack’s presence in the US linehaul market remains minimal. Consequently, without the sales volume to provide the viability for a sizeable investment in a completely new long-haul cab equipped with the advanced electrical architecture needed to adopt Volvo Group’s latest technology, a bulldog on a Volvo snout might eventually prove to be the best option for VGA.

Meanwhile, at UD it’s all systems ‘Go’ with group technology becoming an increasingly prominent feature, particularly as an expanded model range is now being readied for an assault on the local market.

Sure, while the brand’s sales volumes are currently modest, there’s plenty of optimism in the camp with its new Croner soon to hit the medium-duty sector and more notably, the ample opportunities afforded by upcoming versions of its impressive Quon heavy-duty range. A highly competitive eight-wheeler, for instance, is almost certainly on the cards.

However, on the possibility of a turbo-compound engine in Quon, the silence at VGA is again deafening.

Maybe it’s a stretch to suggest, but there is this to consider: It’s no secret that Volvo won’t allow the 13-litre D13 engine in Quon because at 500hp (373kW) and more, it would create too much of a commercial clash with Volvo’s popular FM range. Volvo Group would, in effect, be competing with itself. Consequently, the biggest output in UD comes from the 11-litre group engine topping out at 460hp (343kW).

Fair enough, but what if an 11-litre turbo-compound engine was able to efficiently deliver significantly more grunt than the current 460?

Again, given Volvo’s immense resources and technical expertise, such a development is certainly within the bounds of believability.

Still, when it comes to developments for the Australian market, the whole turbo-compound topic remains rooted in rumour and speculation, and it’ll probably stay that way for at least as long as the corporate doctrine continues to be ‘no comment’.

Or, of course, until speculation morphs into fact.